The best options to invest in Colombia in 2019

We are working on this field in partnership with Guitierrez Group

On January 18, 2019 Forbes magazine listed their 4 Best Places To Buy A Second Home

Overseas In 2019, and once again Colombia, and more particularly Medellin, was

positively recognized.

Where precisely are those investment opportunities? What can a foreign individual

investor do in order to take advantage of them?

In this newsletter, we will explain step-by-step details on, how and where to invest in

Colombia. We will be writing this guide based on our experience of more than 10 years in

serving foreigners who are willing to live and/or invest in our country.

First, let’s tackle the most important premise for any international investor: the exchange rate.

Colombia’s currency is the Colombian Peso (COP). Having an economy dependent on oil

exports makes the country vulnerable to oil prices. The lower the price of oil, the weaker the

COP is against the US Dollar. There’s a clear inverse correlation between the price of the oil

and the price of the COP/USD exchange rate.

Current prices of oil, plus a combination of several other macro and micro economic factors,

havecreated a perfect setting for investors holding US currency wanting to invest in Colombia.

That’s mainly because they get to trade their currency at historically high levels. Today

(February 28, 2019), at an exchange of $3,072+ COP per 1 USD, foreign investors have 60%+

more purchasing power than only 4 to 5 years ago, yet opportunities haven’t necessarily

gotten more expensive. This can be considered as one of the best investment opportunities

available forthem to invest their money in.

On January 18, 2019 Forbes magazine listed their 4 Best Places To Buy A Second Home

Overseas In 2019, and once again Colombia, and more particularly Medellin, was

positively recognized.

Where precisely are those investment opportunities? What can a foreign individual

investor do in order to take advantage of them?

In this newsletter, we will explain step-by-step details on, how and where to invest in

Colombia. We will be writing this guide based on our experience of more than 10 years in

serving foreigners who are willing to live and/or invest in our country.

First, let’s tackle the most important premise for any international investor: the exchange rate.

Colombia’s currency is the Colombian Peso (COP). Having an economy dependent on oil

exports makes the country vulnerable to oil prices. The lower the price of oil, the weaker the

COP is against the US Dollar. There’s a clear inverse correlation between the price of the oil

and the price of the COP/USD exchange rate.

Current prices of oil, plus a combination of several other macro and micro economic factors,

havecreated a perfect setting for investors holding US currency wanting to invest in Colombia.

That’s mainly because they get to trade their currency at historically high levels. Today

(February 28, 2019), at an exchange of $3,072+ COP per 1 USD, foreign investors have 60%+

more purchasing power than only 4 to 5 years ago, yet opportunities haven’t necessarily

gotten more expensive. This can be considered as one of the best investment opportunities

available forthem to invest their money in.

Exchange Rate Behavior (1991 – 2019)

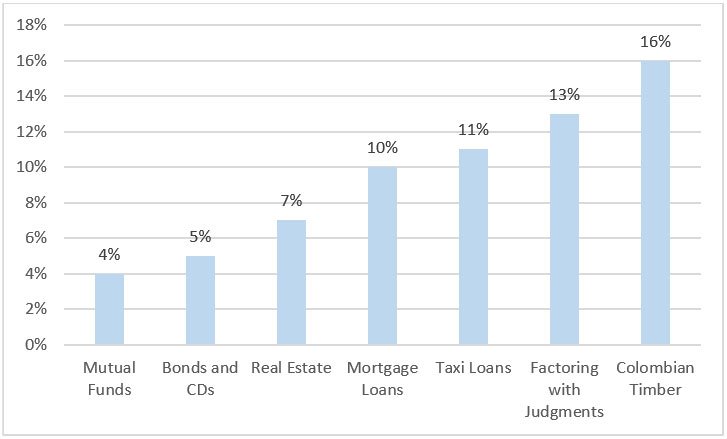

Now, what can the 60%+ extra acquisition power will buy you? Well, opportunities are

everywhere. From the safest alternatives offered by the largest banks and securities brokers,

where yields from 3% to 5% per year can be easily obtained; to tourism-related real estate,

with expected average annual returns of 5% to 8%; to private financing alternatives featuring

safe returns of between 10% and 12% per year; to the always promising and

governmentally-subsidized agro-industry, where 15%+ yields can be expected. In between all

of this, you may find lots of entrepreneurship and alternatives in other types of businesses,

especially in the digital, tourism and gastronomic arenas.

everywhere. From the safest alternatives offered by the largest banks and securities brokers,

where yields from 3% to 5% per year can be easily obtained; to tourism-related real estate,

with expected average annual returns of 5% to 8%; to private financing alternatives featuring

safe returns of between 10% and 12% per year; to the always promising and

governmentally-subsidized agro-industry, where 15%+ yields can be expected. In between all

of this, you may find lots of entrepreneurship and alternatives in other types of businesses,

especially in the digital, tourism and gastronomic arenas.

Mutual Funds, Money Market or interest-bearing accounts

The option for the most cautious.

If you want to invest in Colombia but are not sure precisely where, or you are waiting to

close on that perfect piece of property, but still want to secure the best possible exchange

rate, you can always send USD, convert to COP and simply hold funds in an interest-bearing

account. Our suggestion is to use Securities Brokers, which are much easier to work with,

instead of banks. In Colombia, the most-reputed firms provide a set of mutual funds where

you can earn 2% to 6%, depending on the underlying assets and their associated risk, which

is usually very low.

close on that perfect piece of property, but still want to secure the best possible exchange

rate, you can always send USD, convert to COP and simply hold funds in an interest-bearing

account. Our suggestion is to use Securities Brokers, which are much easier to work with,

instead of banks. In Colombia, the most-reputed firms provide a set of mutual funds where

you can earn 2% to 6%, depending on the underlying assets and their associated risk, which

is usually very low.

Fixed-rent traditional alternatives

Bonds, CDs and T-Bills. Secure assets offering much better yields than US entities.

These are also offered by banks and Securities Brokers. In Colombia, yields of these assets

are much greater than in the North American and European markets. You may expect annual

returns of between 5% and 8% depending on the issuer and term of the particular asset. If

you stick to the safest ones, you may expect 5%.

are much greater than in the North American and European markets. You may expect annual

returns of between 5% and 8% depending on the issuer and term of the particular asset. If

you stick to the safest ones, you may expect 5%.

Real Estate

The constant dilemma between traditional (long-term) and touristic (daily rentals) rental

income.

income.

Let’s face it. When investing internationally, it´s hard to beat brick and mortar. It’s familiar,

perceived as safe, specially by traditional investors, because you get to see and touch it, in

other words, it´s tangible. For most newcomers to Colombia, Real Estate is the very first step

they want to take, and we’re thrilled to be there for them, helping our clients to hunt, close

and manage their properties.

In our expertise, despite what rental agencies like to think, average annual net returns of 4 to

5% may be expected in traditional real estate, and 6 to 8% in tourism-related real estate, not

including a potential valuation of the property. Think over when you hear promises of double-

digit returns in real estate, those are very rarely achieved. It’s important to be cautious, retain

professional and perform proper due diligence before engaging in any major real estate

purchase.

perceived as safe, specially by traditional investors, because you get to see and touch it, in

other words, it´s tangible. For most newcomers to Colombia, Real Estate is the very first step

they want to take, and we’re thrilled to be there for them, helping our clients to hunt, close

and manage their properties.

In our expertise, despite what rental agencies like to think, average annual net returns of 4 to

5% may be expected in traditional real estate, and 6 to 8% in tourism-related real estate, not

including a potential valuation of the property. Think over when you hear promises of double-

digit returns in real estate, those are very rarely achieved. It’s important to be cautious, retain

professional and perform proper due diligence before engaging in any major real estate

purchase.

Private Mortgage Financing

A hassle-free alternative to real estate, with the same underlying asset and better yields.

This is a solid alternative for those willing to secure their investment with a traditional asset

such as real estate, but not having to deal with the daily hassles of owning a rental property.

In Colombia, interest rates are elevated, and local banks are stubborn. When you take a look

at investment banking, you need to pay a lot of attention towards this fact. Hence,

investment companies can be considered as the best option available for you to proceed with.

They don’t service foreigners and are inflexible with terms. In other words, they are unable to

provide tailor-made solutions to their clients. This represents nothing but a unique opportunity to

make money in the business of lending money.

Assuming a very low degree of risk, using short and medium terms, lending only up to 60%

and collateralizing the loan against a liquid property, yields of between 8 and 11% can be

made. And the best thing is that no property manager, nor lousy tenant, gets involved.

such as real estate, but not having to deal with the daily hassles of owning a rental property.

In Colombia, interest rates are elevated, and local banks are stubborn. When you take a look

at investment banking, you need to pay a lot of attention towards this fact. Hence,

investment companies can be considered as the best option available for you to proceed with.

They don’t service foreigners and are inflexible with terms. In other words, they are unable to

provide tailor-made solutions to their clients. This represents nothing but a unique opportunity to

make money in the business of lending money.

Assuming a very low degree of risk, using short and medium terms, lending only up to 60%

and collateralizing the loan against a liquid property, yields of between 8 and 11% can be

made. And the best thing is that no property manager, nor lousy tenant, gets involved.

Factoring against public debt

A best kept secret that will soon fade away.

Feasibly the most truly unique Colombian opportunity of them all. While you can invest in

factoring alternatives in most financial markets, you won’t find this type of factoring

anywhere else in the world. The product consists in buying non-recourse settlements that

have been already won by their claimants, against the Colombian government. After these

claims are settled, the government takes 3 to 4 years to pay, depending on the fiscal budget.

Money from investors is used to pay off claimants in advance at a discounted price (hence

the term factoring), at which point they become the new lawful owners of the economic

rights of the judgment. Expected annual yields of 10 to 13% can be expected in this very safe

product, where the government is the counterparty.

factoring alternatives in most financial markets, you won’t find this type of factoring

anywhere else in the world. The product consists in buying non-recourse settlements that

have been already won by their claimants, against the Colombian government. After these

claims are settled, the government takes 3 to 4 years to pay, depending on the fiscal budget.

Money from investors is used to pay off claimants in advance at a discounted price (hence

the term factoring), at which point they become the new lawful owners of the economic

rights of the judgment. Expected annual yields of 10 to 13% can be expected in this very safe

product, where the government is the counterparty.

And why will this product soon fade away? Because the lawsuits that are being bought

correspond to events related to the armed conflict, which have decreased more than 97%

since the peace agreement was signed in 2015, and with it the availability of new claims to

finance.

correspond to events related to the armed conflict, which have decreased more than 97%

since the peace agreement was signed in 2015, and with it the availability of new claims to

finance.

This product is the main reason why mutual funds in Colombia offer such good yields, as

most securities brokers include this asset in their funds. So, when investing into these funds,

you’re ultimately buying the same asset, in a small proportion.

most securities brokers include this asset in their funds. So, when investing into these funds,

you’re ultimately buying the same asset, in a small proportion.

Agro-industry

One of the country’s hottest picks right now.

Along with development of tourism, agriculture is the government’s most important bet right

now. It is greatly incentivized by means of subsidies and income tax exemptions, depending

on the features of the given development, such as location, economic, social and

environmental impact.

Traditionally, Colombia has had very solid coffee, flowers and banana industries, among others.

These industries are highly competitive, with strong, aggressive players controlling the market,

thus opportunities are limited, and specialization, or being able to produce a premium,

value-added product, is a must. However, there are other industries in their growth or

consolidation stage, where better opportunities can be found. Today, the two fastest-growing

industries in Colombia are avocados and timber.

now. It is greatly incentivized by means of subsidies and income tax exemptions, depending

on the features of the given development, such as location, economic, social and

environmental impact.

Traditionally, Colombia has had very solid coffee, flowers and banana industries, among others.

These industries are highly competitive, with strong, aggressive players controlling the market,

thus opportunities are limited, and specialization, or being able to produce a premium,

value-added product, is a must. However, there are other industries in their growth or

consolidation stage, where better opportunities can be found. Today, the two fastest-growing

industries in Colombia are avocados and timber.

Average Expected Annual Yield per Product

Christian MISSERE TUR

CEO

GLOBAL TRADE & BUSINESS INTERNATIONAL SAS Colombia

GLOBAL TRADE & BUSINESS INTERNATIONAL CORP Panama

+573194407236

whatsapp +573194407236

skype christian.missere

Aucun commentaire:

Enregistrer un commentaire